INSIGHTSPractical, Applicable Knowledge

Revenue Recognition: What it is and Why it Matters

Revenue should be recognized when it is earned, not necessarily when cash is received. This distinction is critical for businesses using the accrual basis of accounting, as opposed to the cash basis of accounting, where revenue is recorded when payment is received.

Profit and Cash Flow: What You Might Not Know

Profit and cash flow. Two standard metrics that every business owner is familiar with, right? You’d be surprised. While folks typically have a general sense of what profit and cash flow are, they don’t always grasp the details and nuanced differences.

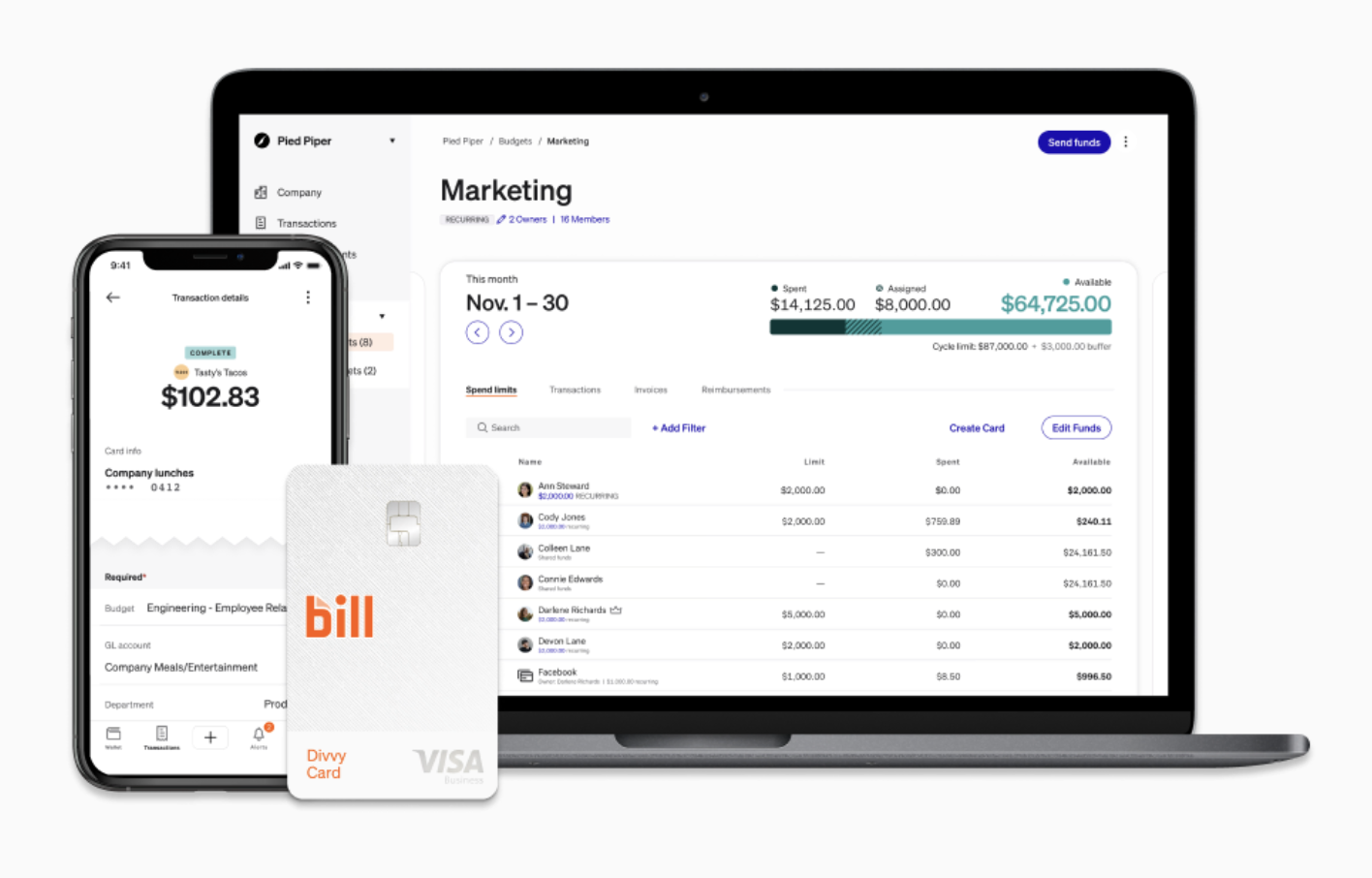

Why We Use Spend and Expense from Bill How it Makes Life Easier for our Clients

Spend and Expense is a solution from BILL, our preferred financial operations platform for our clients. With Spend and Expense, we’re able to streamline expense management for our clients while making it easy for them and their team members to spend (wisely!).

Even the Smallest Businesses Should Offer 401(k)

A 401(k) isn’t just for big corporations – it’s a game-changer for small businesses too. Here’s why.

When a Client Tells Us They’re Thinking of Taking Their Accounting Office In-House

Every now and then, a client comes to us and tells us that they’re thinking about taking their accounting in-house.

Sometimes it is the right move. Sometimes it isn’t. What we try to do in these instances is help our client look at this decision from all angles. Here’s what to consider.

What to Consider for Year-End Bonusing

Generosity is a great company culture trait. But when it touches money, business owners need to be thoughtful about how they go about it. Not doing so will almost certainly lead to financial headaches in the new year. Here’s what we suggest our clients think about when they’re dolling out year-end bonuses.

The Case Against Bundling

Your payroll service almost certainly has a 401(k) administration product and having those two things managed by the same provider seems like it would make a lot of sense. But here’s the truth about bundling.

Let’s Talk About Internal Controls

Internal controls are policies and procedures that companies use to ensure the accuracy and reliability of their accounting and financial information. They also help to prevent fraud and promote accountability. Sounds like something all organizations would have, right? You’d think so.

Don’t Look Now, But We’re Two-Thirds of the Way Through 2024

To truly know where your business stands at the two-thirds pole of 2024 and to optimize the rest of the year, we’ve compiled a few immediate to-dos.

An Approachable Dive into the Cash and Accrual Basis Accounting Methods

There are two methods of accounting: cash basis and accrual basis. Most bookkeepers and accountants are familiar with both. Surprisingly, many business owners are not. Here’s an overview of each, what makes them different, and how organizations can best use both.

Team Member Spotlight: Connie Brown

At Walsh Accounting, our people are what make the difference. Each quarter, we profile a Walsh Accounting team member, sharing a little bit about what they do, how they got here and what matters to them outside the world of accounting, bookkeeping and payroll. In this installment, we sit down with director of client operations, Connie Brown.

Is Your Accounting Office Giving Your Business What It Needs?

Sometimes a business has an internal or external accounting resource that has largely been doing the same thing over and over. For years. They’re processing paper, ensuring basic accuracy, and getting paid. Rinse and repeat. While that may sound fine, it isn’t. Not for a modern, growing business.

Telling Our Story

In 2023, we spent a ton of effort refining and formalizing internal systems. 2024 is the year we’ve committed to telling our story.